It’s That Time of the Year!

Let’s be honest. We all know there are better ways to spend our time and taxes isn’t on top of that list. SO how can you make the most of this season without feeling like you’re paying too much?

Let’s be honest. We all know there are better ways to spend our time and taxes isn’t on top of that list. SO how can you make the most of this season without feeling like you’re paying too much?

When tax season comes, you’ll probably do an online search for free tax software and more chances than not, you’ll find plenty of free or low-cost options—even the IRS offers free software for certain taxpayers.

Did you know that the IRS does not currently have any guidelines for who can prepare your tax returns? That can make it a challenge for the 56% of American taxpayers who hire someone to prepare their income taxes. How can you know you’re getting the expertise you’re paying for?

The property tax system that Texans know today is vastly different from what it was even a few decades ago. The modern Texas Property Tax Code is full of complex details, most of which have little bearing on the average homeowner. However, there are a few key details that every property owner should know.

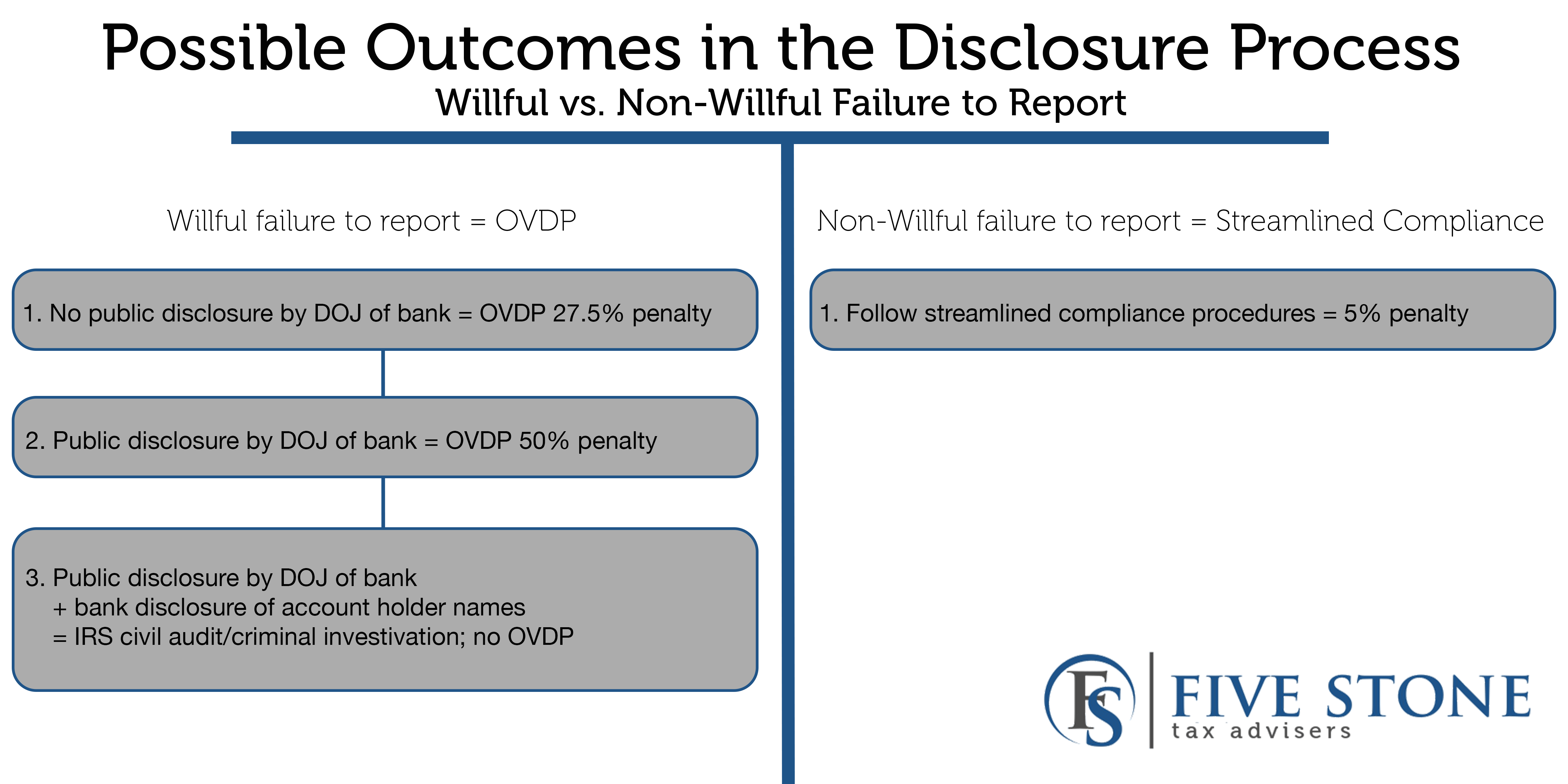

The IRS has recognized that it would be impossible to catch every taxpayer with outstanding obligations to the IRS. Therefore, when a significant area of noncompliance is determined by the IRS, it uses Voluntary Disclosure Programs (VDP) as a way to entice taxpayers to voluntarily come forward and disclose non-compliance without the fear of criminal prosecution and/or draconian penalties.

The IRS has reduced its training budget by more than 85 percent in an effort to cut agency-wide costs. In 2013, the IRS spent $250 per employee on training; in 2009, they spent $1,450 per employee.

In an effort to assist taxpayers navigate compliance with reporting delinquent foreign financial accounts, the IRS has implemented some new programs. There are risks to consider with each; however, not disclosing foreign accounts could have devastating financial consequences.

The 2014 Offshore Voluntary Disclosure Program (OVDP), which helps United States taxpayers with undisclosed foreign financial accounts achieve compliance with the Internal Revenue Service (IRS), is in full swing.

The deadline for Swiss banks to comply with the Department of Justice and turn over data regarding their U.S. account holders has passed. Next, the Department of Justice will begin the process of publicly disclosing banks under investigation.

If you have moved your accounts from Switzerland to another country because of an impending investigation, or you’re considering doing so, think twice about it.

©2025 Five Stone Tax Advisers, LLC. All Rights Reserved.

Privacy Policy | Disclaimer