Quiet Disclosures: Why the IRS Views this Negatively

Here is a quick, easy breakdown of why the practice of quiet disclosures are strongly discouraged by practitioners and the IRS.

Here is a quick, easy breakdown of why the practice of quiet disclosures are strongly discouraged by practitioners and the IRS.

On September 9th, 2014, a multi-count indictment for securities fraud, tax fraud and money laundering was unsealed in federal court against six corporate executives and six corporate entities[1].

The Department of Justice issued a press release detailing the sentencing of two Caribbean-based professionals, an investment advisor and an attorney, for laundering money through undisclosed offshore accounts.

Some taxpayers with undisclosed offshore accounts are attempting to either enter the Offshore Voluntary Disclosure Program (OVDP), indicating willful failure to disclose accounts, or adhere to the Streamlined Filing Compliance Procedures (SFCP), indicating non-willful failure to disclose accounts, without the aid of an experienced attorney. The reasons below outline why willfulness determination should be entrusted to an attorney.

Some taxpayers with undisclosed offshore accounts are attempting to either enter the Offshore Voluntary Disclosure Program (OVDP), indicating willful failure to disclose accounts, or adhere to the Streamlined Filing Compliance Procedures (SFCP), indicating non-willful failure to disclose accounts, without the aid of an experienced attorney. The reasons below outline why willfulness determination should be entrusted to an attorney.

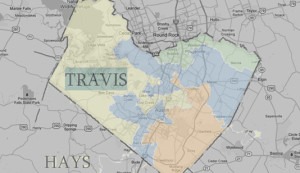

Austin, TX (October 14, 2014) – Five Stone Tax Advisers uncovers that thousands of commercial properties in Travis County, Texas, may be eligible for an additional 7 percent reduction in appraised value.

Raoul Weil was the head of UBS AG’s global wealth management business and went into hiding after he was indicted in 2008 in a Federal Court in Florida. The indictment showed that Mr. Weil allegedly advised 17,000 U.S. taxpayers to hide $20 billion in income and assets.

Ireland is notorious for offering a United States tax shelter called the “Double Irish” to large U.S. companies.

Similar to the model rules of ethics or the uniform rules of evidence, probate or the commercial code, a uniform code of foreign income state taxation would make the analysis for state tax planning consistent and transparent.

The 100 Swiss Category 2 banks that signed up for the Department of Justice non-prosecution agreement (NPA) deal last December (2013) have just received the details of what is needed to comply.

©2021 Five Stone Tax Advisers, LLC. All Rights Reserved.

Privacy Policy | Disclaimer